Firm Newsletter | January 2026

Dear Clients and Friends:

We hope you had a wonderful holiday season and that your year is off to a great start. We write to update you on recent activities at FRB. We have a lot of exciting initiatives in the pipeline for 2026 and are glad that you are along for the ride.

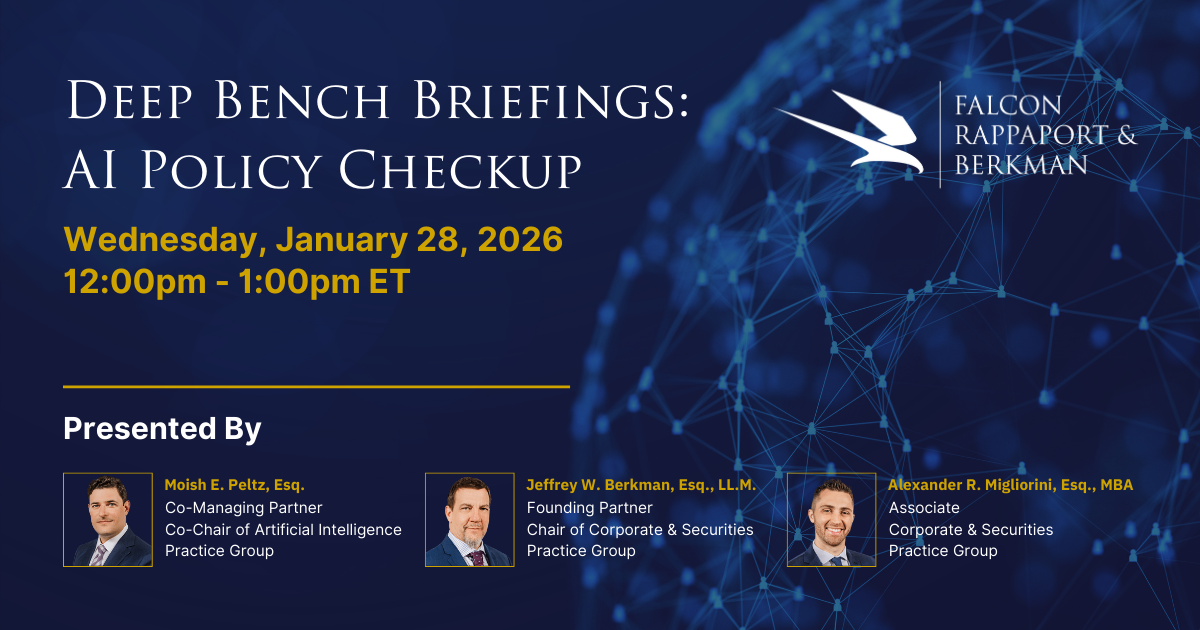

As companies rush to adopt AI, having a sound legal approach and an effective AI policy is critical to protecting your business.

We invite you to join FRB Founding Partners Moish E. Peltz, Esq. and Jeffrey W. Berkman, Esq., LL.M., and Corporate Associate Alexander R. Migliorini, Esq, MBA, on Wednesday, January 28, from 12:00 PM - 1:00 PM ET for our "AI Policy Checkup" webinar, the first session of the Deep Bench Briefings. We will cover:

- Where customers, vendors, and employees quietly create AI liability

- The blind spots most AI policies miss—from customer terms and vendor oversight to everyday employee use cases (even when companies think they’re “covered”)

- Where other lean legal teams have tripped up, and how to avoid the same traps

- Practical guardrails, sample clauses, and checklists you can put in place quickly—without slowing business units down

Register below and stay tuned for updates on the helpful Deep Bench Briefings to come.

Register for the Deep Bench Briefings Series

Register here.

FRB Attorneys in the News

- We’re proud to share that Andrew Cooper, Chair of FRB’s Cannabis & Psychedelics Practice Group, has been named in the Global Top 200 Cannabis Lawyers (2025/26) by Cannabis Law Report and Cannabis Law Journal. This guide recognizes leading practitioners shaping the legal and regulatory landscape for cannabis worldwide. Congratulations Andrew on this recognition! Check out the list here.

- Also, we’re excited to congratulate Steven Cooper for being recognized by the International Trademark Association (INTA) as a High-Performing Committee Member for his 2025 service on the Young Practitioners Committee, where he served as Co-Chair of the Awards & Fellowships Subcommittee and helped expand access to the program across the global trademark community. Congratulations Steven!

Register for Our Upcoming Webinars & Events

Webinar: Effective Use of IRA Trusts in Estate Planning under the New Retirement Distribution Rules

- Join FRB’s Angela M. Stockbridge, Esq., Megan E. Wilson, Esq., LL.M., and Sy Goldberg of Goldberg & Goldberg PC on Thursday, January 22, from 12:30 PM - 1:30 PM ET for a timely discussion on post-SECURE Act inherited IRA rules, including the 10-year rule, annual RMD requirements, and practical trust planning strategies to help beneficiaries and trustees reduce penalty exposure as IRS enforcement resumes.

- Learn more and register here.

Webinar: AI Policy Checkup

- Join FRB’s Moish E. Peltz, Esq., Jeffrey W. Berkman, Esq., LL.M., and Alexander R. Migliorini, Esq., MBA on Wednesday, January 28, from 12:00 PM - 1:00 PM ET for a hands-on discussion on building effective AI policies, including must-have provisions, common gaps, and practical checklists and sample clauses you can use right away.

- Learn more and register here.

Webinar: LLC Structures for Real Estate Investments: From Entity Formation to Advanced Risk Management (2026 Edition)

- Join Matthew E. Rappaport, Esq., LL.M. on Friday, January 30, from 1:00 PM - 3:10 PM ET to explore corporate and tax structuring strategies for real estate ownership, including asset protection planning, 1031 exchanges, single-member LLCs, Opco/Propco models, and more as he provides practical guidance to help mitigate risk and optimize tax efficiency for real estate investors and their advisors.

- Learn more and register here.

Webinar: The Impact of the New Tax Bill on Real Estate: Key Changes and Strategic Planning

- Join Matthew E. Rappaport, Esq., LL.M. on Thursday, February 5, from 1:00 PM - 3:10 PM ET and examine how recent federal tax legislation is reshaping real estate investment and transaction planning, with a focus on Qualified Opportunity Zones under the One Big Beautiful Bill Act, the continued use of Section 1031 exchanges, and key developments affecting depreciation, capital gains, and state and local taxes.

- Learn more and register here.

Check Out Our Latest Podcasts

How Tax Works - Ep. 43

Allocations Under IRC 704(c)

- In episode 43 of How Tax Works, Matthew E. Foreman, Esq., LL.M. discusses the three allowable methods Traditional, Traditional with Curative Allocations, and Remedial; the Ceiling Rule problem and how each method creates or mitigates the Ceiling Rule problem; and whether Other Reasonable Methods are really a viable option.

- Listen to the episode here.

Block & Order #48

Crypto is the Most Auditable Asset feat. Steven Baum

- In this episode of Block and Order, hosts Kyle M. Lawrence, Esq. and Moish E. Peltz, Esq. are joined by Steven Baum, Managing Director at CBIZ and co-leader of its Digital Assets & Blockchain practice, to unpack crypto auditing and financial reporting. Steven explains why blockchain assets may actually be easier to audit than cash and how crypto companies are maturing into IPO-ready businesses. The conversation covers regulatory uncertainty, stablecoins, DeFi infrastructure, digital asset treasuries, and the growing role of AI in compliance.

- Watch the episode here.

FRB Welcomes Amarilda B. Fligstein

Amarilda B. Fligstein, Esq.

FRB is pleased to welcome Amarilda B. Fligstein, Esq. as Senior Counsel in our Elder Law and Probate & Administration of Trusts & Estates Practice Groups. She advises individuals and families through all stages of elder law and estate planning, with a particular focus on guardianship and Surrogate’s Court matters involving incapacitated and intellectually or developmentally disabled individuals. Amarilda is frequently appointed by the Court in key fiduciary and advocacy roles and is widely recognized for her compassionate, solutions-oriented approach and commitment to community service.

Check Out Our Past Webinars

Webinar: Business Law from A to Z

- Matthew E. Foreman, Esq., LL.M., James M. Black, Esq., Richard E Weltman, Esq., Daniel J. Gershman, Esq., and Michelle S. Kabel, Esq. cover the full spectrum of business law essentials. Topics include entity selection, LLC formation, business contracts, transfer of interests, and emerging technology issues.

- Watch here.

Webinar: Building an AI-Ready Business: Strategy, Policy, and Practice

- Jeffrey W. Berkman, Esq., LL.M., Douglas E. Singer, Esq., and Alexander R. Migliorini, Esq., MBA, alongside Kathy D'Agostino, explore how to integrate AI responsibly and effectively, without risking your clients’ trust or your company’s integrity + cover real-world strategies for AI policy development, ROI assessment, and ethical adoption.

- Watch here.

Webinar: The Advanced Tax Strategy Series

- Matthew E. Foreman, Esq., LL.M. helps professionals seek deeper insights into sophisticated tax planning. View all four sessions below

- Watch here.

Check Out Our Latest Insights & News

Stay-or-Pay Agreements Meet Their End in New York

New York’s new Trapped at Work Act is reshaping employer-employee agreements. Effective December 19, 2025, most stay-or-pay and training repayment provisions are now void – and violations can carry penalties of up to $5,000 per worker. Elizabeth Schlissel breaks down what’s prohibited, what’s still allowed, and the critical steps employers should take now to stay compliant. Read more.

Voluntary Benefits Are Not “Low-Risk”: A New Wave of ERISA Fiduciary Litigation

Voluntary benefits may no longer be the “low-risk” option employers think they are. Angela Stockbridge breaks down emerging ERISA class actions and what they mean for employers, brokers, and benefits committees. Read more.

New Year, New Wage: Are You Ready?

New York’s minimum wage and exempt salary thresholds will increase on January 1, 2026, with rates varying by location and employee classification. Elizabeth Schlissel outlines the various wage increases and steps employers should take now. Employers who fail to implement these changes correctly may face increased compliance risk. Read more.

New York’s RAISE Act Is Now Law: What It Means for New York Businesses

Governor Hochul has signed the RAISE Act into law, raising the bar for AI safety in New York – without regulating most businesses directly. Moish Peltz and Kyle Lawrence explain what the law means for vendor diligence, contracting, and AI risk management + how businesses can implement practical, defensible governance in response. Read more.

Why MUSIC.AI’s Trademark Failed: Descriptive Marks, TTAB Risk, and Branding Strategies for AI and Technology Companies

A recent TTAB decision rejecting MUSIC.AI is a reminder that descriptive AI product names are hard to protect as trademarks. Moish Peltz explores why distinctiveness, not speed to market, is critical to building protectable AI and tech brands. Read more.

New York’s Medical Aid in Dying Act: What the Governor’s Announced Deal Means for Patients and Families

New York is on the brink of a major shift in laws governing end-of-care with the announcement of the state's anticipated adoption of the Medical Aid in Dying Act. Dana Walsh Sivak examines what Governor Hochul’s deal to sign the controversial Medical Aid in Dying Act means for older adults, caregivers, health care providers, and estate planning in New York. Read more.

Enforcement Date Approaches for Inherited IRA Beneficiaries

If you inherited a traditional IRA after 2019, the rules have changed and timing matters. Under the SECURE Act, most non-spouse beneficiaries must fully distribute inherited IRAs within 10 years, with potential annual RMD and tax implications. Angela Stockbridge explains what beneficiaries need to know. Read more.

A Preference “Playbook”: Judge Walrath’s CalPlant Decision Clarifies Key Defenses Under Bankruptcy Code 11 U.S.C. § 547

A same-day payment isn’t always a safe payment. Michael Moskowitz explains how Judge Walrath’s CalPlant decision offers a clear roadmap for analyzing ordinary course and contemporaneous exchange defenses under §547(c). Read more.